How To Enter A Standard Invoice

1.

Payables

Responsibility > Invoices >Entry > Invoices

2. Enter Invoice

Header Information

Enter the information below on the invoice header:

Type: Standard

Supplier: Enter supplier name from invoice

Site: Select a payment site if the field does not automatically populate

Invoice Date: Enter the invoice date

Invoice Number: Enter the invoice number

Amount: Enter the amount of the invoice (this is the gross amount - it includes the net amount and tax amount)

Save.

Every invoice entered will be saved in the invoice tables on the databases

SQL Query

SELECT DISTINCT vi.invoice_id,

vi.invoice_type_lookup_code,

v.vendor_name as Trading_Partner,

v.segment1 as Supplier_Number,

vs.Vendor_site_code as Supplier_Site_Code,

vi.invoice_num,vi.invoice_date,

vi.invoice_amount,vi.tax_amount

FROM AP_SUPPLIERS v

, AP_SUPPLIER_SITES_ALL vs

, AP_CHECKS_ALL ac

,ap_invoices_all vi

WHERE v.vendor_id = '11'

and vs.vendor_site_id = '2332'

and vi.invoice_num = 'IA_TEST01';

Fill in the Amount of the invoice (the Amount should be the

Net amount on the invoice (this amount excludes the tax amount.)

Sample Invoice

4.

Enter Tax information by selecting the

rate used on the invoice which will be available to select on the system.

4.

Enter Tax information by selecting the

rate used on the invoice which will be available to select on the system.

5.

Click

on the Distributions button to enter Account Code Combinations.

Please

note account code combinations must be made available as part of the invoice

approval process. I will be discussing invoice approval process shortly.

Save.

6. Calculate Tax

using the “Calculate Tax” button

SQL Query

SELECT invoice_id, line_number, line_type_lookup_code, amount,

tax_classification_code, match_type

FROM ap_invoice_lines_all

WHERE invoice_id = '322289';

7. Once tax is

calculated, we can see the invoice status and amount on the general tab as

shown below.

8. To completely

process an invoice for payments, it has to be validated and free from any

holds. I will be discussing type of holds shortly

9. Click the Action

button to see all the available invoice actions

|

|

|

|

|

|

Validate Related Invoices

|

To Validate all related invoices to the one selected for validation

|

|

|

|

|

|

To apply and unapply prepayments

|

|

|

|

|

|

To account for the invoice for financial reporting purposes

|

|

|

To send the invoice for approval.

|

|

|

To stop/cancel any approval process on the invoice

|

|

|

To release any hold placed on the invoice

|

|

|

To print notice for invoice/payments

|

10. Check “Validate to validate the invoice

11. Once Validated , the invoice status will change to “Validated”

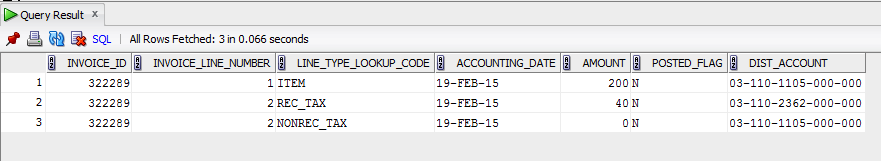

SQL Query

SELECT

invoice_id, invoice_line_number, line_type_lookup_code, accounting_date,

amount, posted_flag, gcc.concatenated_segments

DIST_ACCOUNT

FROM

ap_invoice_distributions_all AID , gl_code_combinations_kfv

gcc

WHERE

Invoice_id = '322289'

AND gcc.code_combination_id = aid.DIST_CODE_COMBINATION_ID

12. Accounting For Invoices

You can create accounting entries for invoice and payment transactions

in Oracle Payables using the Oracle Subledger Accounting architecture.

Subledger Accounting is a rule-based accounting engine, toolset, and

repository that centralizes accounting across the E-Business Suite. Acting as

an intermediate step between each of the subledger applications and Oracle

General Ledger, Subledger Accounting creates the final accounting for subledger

journal entries and transfers the accounting to General Ledger.

Accounting can be created in 3 different modes.

1. In Draft – This option created the accounting entries for review purposes

and can be re-created.

2. Final – This creates the final accounting entries. These

entries are final and cannot be re-created.

3. Final Post –

This option creates the final

accounting and posts the entries into General Ledger – I will explain the

reason for posting to General Ledger at a later date.

After Payables creates accounting entries, you can view the

accounting entries in the following windows in Payables:

The View Accounting screen displays the accounting

created for the invoice. The screen

displays 3 sections;

1. Header – This shows the Ledger, Journal Entry Status ( Draft, Final or

Final Post) and GL Date, Journal category, Completion Date, Journal Entry Type

and Journal Description

2. Transaction Information – Shows details of the Supplier

(Supplier Name and Supplier Site Name) and Invoice Details.

3. Lines – Shows the accounting entries for

the transaction. This is where you need your accounting double entry knowledge.

(Debuts and Credits)

13. Payables Accounting Events

An accounting event is a Payables transaction that has

accounting impact. Not all accounting events have accounting impact; you can

modify the accounting setup to create accounting for some events and not for

others

Accounting events are categorized into event types. Event

types are grouped into event classes that in turn are grouped into event

entities. The overall grouping of these components is called an event model.

AP Invoice

Events For A Standard Invoice

|

Event

Class

|

Event

Types

|

|

Standard Invoices

|

Standard Invoice Cancelled

Standard

Invoice Created

Standard

Invoice Distributed

Standard

Invoice Frozen

Standard

Invoice Reversed

Standard

Invoice Tax Holds Released

Standard

Invoice Tax Distributions Overridden

Standard

Invoice Tax Overridden

Standard

Invoice Redistributed

Standard

Invoice Unfrozen

Standard

Invoice Updated

Standard

Invoice Validated

|

Labels: Invoice, Invoice Tables, Oracle Payables